AI in Chemicals Market by Component (Hardware, Software (by Type, Technology, and Deployment Mode) and Services), Business Application, End User (Basic Chemicals, Active Ingredients, and Paints & Coatings) and Region - Global Forecast to 2029

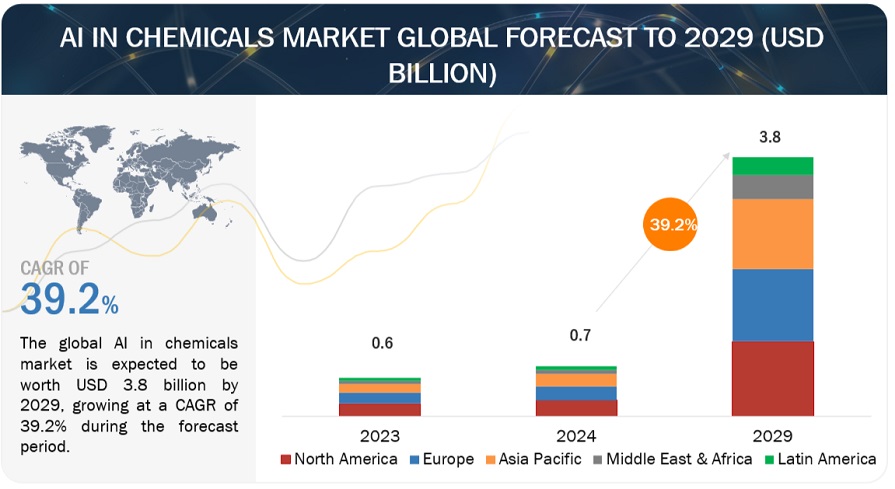

[360 Pages Report] The global market for the AI in chemicals market is projected to grow from USD 0.7 billion in 2024 to USD 3.8 billion by 2029 at a CAGR of 39.2% during the forecast period. AI's influence in the chemical sector spans product development, demand forecasting, and quality testing, with notable applications such as predictive maintenance, process optimization, virtual screening, and molecular modeling. These innovations accelerate computational algorithms, unveiling insights crucial for material discovery and process refinement. By leveraging machine learning, the chemical industry experiences heightened efficiency and innovation, paving the way for transformative advancements in materials, formulations, and processes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing demand of AI for research & development

The growing emphasis on research and development within the chemical and materials sector is fueling the surge in demand for AI technologies. AI solutions are indispensable in accelerating and refining the R&D process, with ML tools swiftly identifying molecules, formulating precise chemical compositions, and predicting their efficacy. Through AI integration, companies can forecast environmental impacts, bolstering sustainability efforts by opting for greener alternatives. Automation of experiments not only enhances efficiency but also ensures accuracy, yielding substantial time and resource savings while enhancing safety protocols. Cloud-based platforms further amplify collaboration and automation, ushering in an era of heightened efficiency and adaptability. Studies indicate potential reductions in R&D costs ranging from 30% to 50%, a fivefold increase in experiment throughput, and up to a 30% reduction in the lab workforce through automation. These quantifiable benefits underscore the pivotal role of AI in shaping the future landscape of chemical and materials research, driving efficiency, sustainability, and innovation.

Restraint: High cost associated with AI implementation in chemical industry

The high cost of implementing AI in the chemical sector acts as a significant restraint on its growth. Developing and deploying AI solutions in chemical processes requires substantial investment in technology, infrastructure, and expertise. Companies need to allocate funds for acquiring or developing AI algorithms, integrating them into existing systems, and providing training for personnel. Additionally, upgrading infrastructure to support AI implementation, such as sensors and data storage systems, incurs significant costs. Moreover, hiring skilled professionals with expertise in both AI and chemistry adds to the expenses. For smaller chemical companies with limited financial resources, the upfront costs of implementing AI may be prohibitive, leading to slower adoption rates. Even for larger companies, the substantial initial investment required for AI implementation necessitates careful consideration and strategic planning, potentially delaying widespread adoption across the chemical sector.

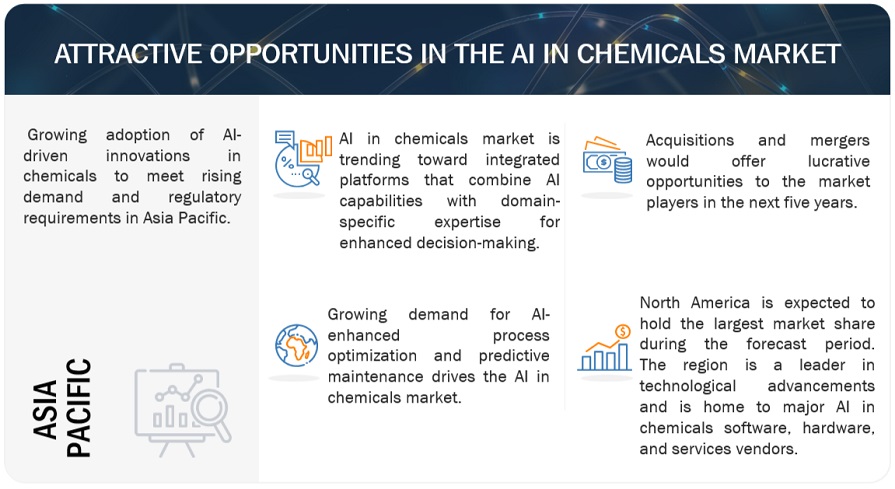

Opportunity: Growing demand for AI-based predictive maintenance

The escalating demand for predictive maintenance in the chemical sector offers a fertile ground for AI expansion. Chemical industries are increasing their spending on AI-based predictive maintenance by approximately 36% to reduce downtime and improve productivity. This trend indicates a growing recognition within the industry of the potential benefits of AI in enhancing operational optimization and gaining competitive advantages. This proactive maintenance strategy relies on AI and machine learning algorithms to analyze historical and real-time data from production equipment, enabling the prediction of potential issues before they escalate. By minimizing downtime, extending equipment lifespan, and reducing overall maintenance costs, AI-driven predictive maintenance promises substantial benefits for chemical manufacturers. With significant cost savings and operational improvements anticipated, integrating AI with advanced planning and scheduling tools can further enhance maintenance strategies, ensuring higher equipment reliability and operational efficiency.

Challenge: Issues related to converting chemical data into machine-readable data

The conversion of information into machine-readable data poses a significant challenge for AI adoption in the chemical sector. The complexity and diversity of chemical data, spanning various formats like text, images, and diagrams, require extensive preprocessing and standardization efforts for machine interpretation. Ensuring the accuracy and reliability of this converted data is critical to prevent potentially hazardous outcomes or financial setbacks. Moreover, safeguarding proprietary information during the conversion process is essential to mitigate the risk of intellectual property theft or breaches. Furthermore, integrating data from disparate sources, including laboratory experiments and production records, adds complexity, demanding seamless interoperability for meaningful insights. Addressing these challenges is crucial for unlocking the transformative potential of AI in the chemical industry, and facilitating advancements in areas, such as process optimization, predictive maintenance, and innovative product development.

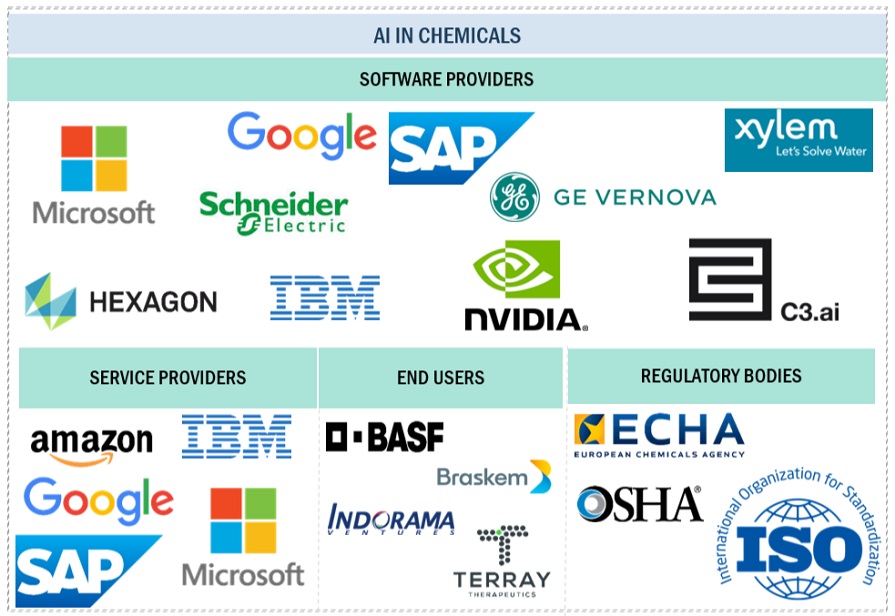

AI in chemicals Market Ecosystem

The AI in chemicals market ecosystem comprises hardware providers supplying essential physical components, software providers offering tailored AI algorithms and platforms, service providers delivering consulting and implementation services, end users utilizing AI technologies for operational enhancement, and regulatory bodies setting guidelines and standards for ethical and safe AI adoption. This interconnected network supports innovation, efficiency, and compliance within the chemical industry's AI-driven landscape.

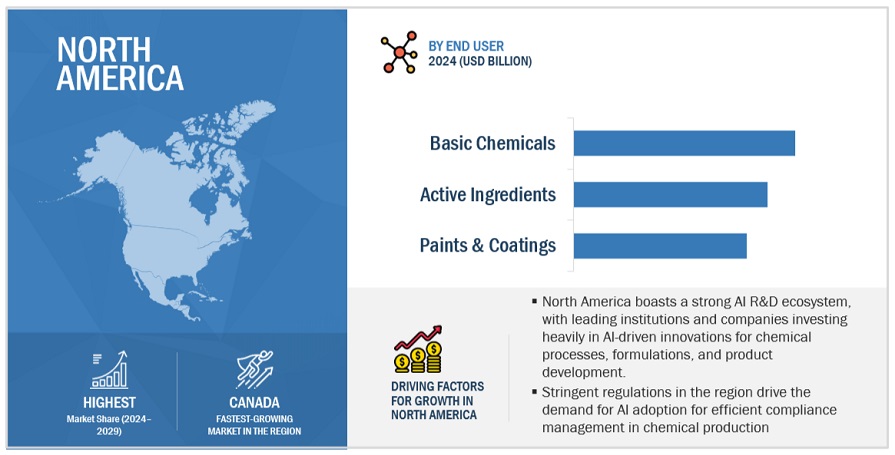

By End User, Basic Chemicals segment accounts for the largest market size during the forecast period.

The basic chemicals industry, which includes petrochemicals, lubricants, commodity chemicals, and inorganic chemicals and gases, is experiencing a significant shift towards unparalleled efficiency and innovation with the adoption of artificial intelligence. AI technologies, such as machine learning, predictive analytics, and autonomous systems, are fundamentally changing traditional manufacturing processes and operational strategies within these sectors' traditional manufacturing processes and operational strategies. For instance, predictive maintenance algorithms are being used in petrochemical refineries to preemptively identify equipment failures, minimize downtime, and optimizing optimize production output. In commodity chemical plants, intelligent process control systems are being empowered by AI algorithms to ensure precise monitoring and adjustment of variables, leading to enhanced product quality and resource utilization.

By Software Type, chemical modeling software is projected to grow at the highest CAGR during the forecast period.

Chemical modeling software is a cutting-edge advanced advancement in the chemicals market that offers sophisticated tools for molecular design, simulation, and analysis market that offers sophisticated molecular design, simulation, and analysis tools. These software solutions use AI technologies such as machine learning and deep learning to model complex chemical structures, predict molecular properties, and simulate chemical reactions with a high degree of accuracy. By leveraging extensive databases of chemical data and computational algorithms, chemical modeling software enables researchers and engineers to explore new materials, optimize formulations, and design molecules for specific applications, such as pharmaceuticals, polymers, catalysts, and specialty chemicals. Key features of these software solutions include structure-based design, property prediction, virtual screening, and molecular dynamics simulations. These features allow users to accelerate R&D cycles, reduce experimentation costs, and discover breakthrough innovations.

North America to account for the largest market size during the forecast period.

North America has been a leader in AI research and development for decades. The region's elite universities have played a crucial role in pioneering key technical advancements, such as neural networks and deep learning, which are foundational to AI's evolution. Home-grown tech giants, particularly in the US, dominate global AI investment and intellectual property development dominate global AI investment and intellectual property development, particularly in the US, driving innovation across sectors, including chemicals. The region maintains a dynamic regulatory landscape that addresses AI's ethical and operational aspects. Organizations operating in the AI in chemicals sector comply with regulations set by authorities, such as the Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and International Council of Chemical Associations (ICCA), ensuring responsible AI deployment and adherence to industry standards. North America has a thriving AI industry that is actively investing in research and development within the chemicals industry. Notable players such as IBM, Microsoft, NVIDIA, and C3 AI are driving AI innovation and developing solutions to improve efficiency, sustainability, and safety within chemical processes.

Key Market Players

The major AI in chemicals hardware, software and service providers include IBM (US) , Schneider Electric (France), Google (US) , Microsoft (US) , SAP (Germany), AWS (US), NVIDIA (US), C3.ai (US), GE Vernova (US), Siemens (Germany), Hexagon (Sweden), Engie Impact (US), TrendMiner (Belgium), Xylem (US), NobleAI (US), Iktos (France), Kebotix (US), Uptime AI (US), Canvass AI (Canada), Nexocode (Poland), SandboxAQ (US), Deepmatter (England), Zapata AI (US), Citirne Informatics (US), Chemical.AI (China), Augury (Israel), Intellegens (UK), Ripik.AI (India), Tractian (US), Polymerize (Singapore), ScienceDesk (Germany), OptiSol Business Solutions (India), NuWater (Africa) and VROC (Australia). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the AI in chemicals market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Component (Hardware [Accelerators, Processors, Memory, Network], Software [Software By Type {Dashboard & Analytics Tools, Process Simulation Software, Chemical Modeling Software, Laboratory Management Software, Virtual Screening Tools, Chemical Property Prediction Tools}, Software By Technology {ML, Deep Learning, Generative AI, NLP, Computer Vision, Advanced Analytics}, Software By Deployment Mode {Cloud, On-Premises}], and Services [Professional Services {Consulting, Deployment & Integration Services, Support & Maintenance Services} and Managed Services]), Business Application (R&D, Production, Supply Chain Management, and Strategy Management), End User (Basic Chemicals, Advance Materials, Active Ingredients, Green & Bio-Chemicals, Paints & Coatings, Adhesives & Sealants, Water Treatment & Services, and Other End Users) and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Schneider Electric (France), AWS (US), Google (US), SAP (Germany), NVIDIA (US), C3.ai (US), GE Vernova (US), Siemens (Germany), Hexagon (Sweden), Engie Impact (US), TrendMiner (Belgium), Xylem (US), NobleAI (US), Iktos (France), Kebotix (US), Uptime AI (US), Canvass AI (Canada), Nexocode (Poland), SandboxAQ (US), Deepmatter (England), Zapata AI (US), Citirne Informatics (US), Chemical.AI (China), Augury (Israel), Intellegens (UK), Ripik.AI (India), Tractian (US), Polymerize (Singapore), ScienceDesk (Germany), OptiSol Business Solutions (India), NuWater (Africa) and VROC (Australia). |

This research report categorizes the AI in chemicals market based on component (hardware, software [By type, technology, deployment mode] & services), business application, end user and region.

Component:

-

Hardware

- Accelerators

- Processors

- Memory

- Network

-

Software

-

By Type

- Dashboard & Analytics Tools

- Process Simulation Software

- Chemical Modeling Software

- Laboratory Management Software

- Virtual Screening Tools

- Chemical Property Prediction Tools

-

By Technology

- ML

- Deep Learning

- Generative AI

- NLP

- Computer Vision

- Advanced Analytics

-

By Deployment Mode

- Cloud

- On-Premises

-

By Type

-

Services

-

Professional Services

- Consulting Services

- Deployment & Integration Services

- Support & Maintenance Services

- Managed Services

-

Professional Services

By Business Application:

- R&D

- Production

- Supply Chain Management

- Strategy Management

By End User:

- Basic Chemicals

- Advance Materials

- Active Ingredients

- Green & Biochemicals

- Paints & Coatings

- Adhesives & Sealants

- Water Treatment & Services

- Other End Users

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments:

- In March 2024, AWS and NVIDIA collaborated to enhance computer-aided drug discovery using new AI models. Their collaboration focuses on modeling the efficacy of new chemical molecules, predicting protein structures, and gaining insights into how drug molecules interact with biological targets, contributing significantly to advancements in pharmaceutical research and development.

- In January 2024, A robotic chemistry lab collaborated with Google AI to predict and synthesize novel inorganic materials, leveraging advanced algorithms and automation for accelerated material discovery and development.

- In November 2023, GE Vernova’s Gas Power business announced its collaboration with Duke Energy on the nation’s first 100% green hydrogen-fueled peaking power plant. GE Vernova will support the development of an end-to-end green hydrogen system at Duke Energy’s DeBary plant in Volusia County, Florida, near Orlando.

- In October 2023, NobleAI, known for Science-Based AI solutions in Chemical and Material Informatics, partnered with Azure Quantum Elements (AQE), a Microsoft cloud service merging High-Performance Computing (HPC), AI, and quantum computing. This collaboration integrated AQE's advanced molecular simulation, and HPC features with NobleAI's AI-driven solutions.

- In May 2023, Google Cloud unveiled two new AI-powered life sciences solutions to speed up drug discovery and precision medicine for biotech companies, pharmaceutical firms, and public sector organizations. The Target and Lead Identification Suite aids researchers in identifying amino acid functions and predicting protein structures, while the Multiomics Suite accelerates genomic data discovery and interpretation, facilitating the design of precision treatments.

- In May 2023, The chemical industry is collaborating with Siemens on a pilot project to reduce carbon emissions in its supply chain. This partnership is part of the Together for Sustainability initiative, involving 47 chemical companies that opted for Siemens' "Sigreen" solution for digitally exchanging Product Carbon Footprint (PCF) data.

- In April 2023, Mitsui Chemicals and IBM Japan collaborated to enhance agility and accuracy in discovering new applications by merging Generative Pre-trained Transformer (GPT) with IBM Watson Discovery. They aim to drive sales and market share growth for Mitsui Chemicals products through advanced digital transformation (DX) in the business sector.

Frequently Asked Questions (FAQ):

What is AI in chemicals?

AI in chemicals refers to the application of artificial intelligence techniques, such as machine learning and predictive analytics, to optimize various aspects of the chemical industry. It includes enhancing R&D processes, optimizing production workflows, improving quality control, and enabling predictive maintenance, leading to greater efficiency, innovation, and competitiveness within the sector.

Which region is expected to hold the highest share in the AI in chemicals market?

North America holds the highest market share in AI applications within the chemicals sector driven by its advanced technological infrastructure, strong investment in research and development, and a robust ecosystem of AI talent and expertise. The region's focus on innovation and digital transformation, coupled with favorable regulatory frameworks, positions it as a leader in harnessing AI's potential to drive efficiencies, optimize processes, and spur innovation across the chemical industry value chain.

Which are key end users adopting AI in chemicals hardware, software and services?

AI in chemicals components is adopted by various end users, including Basic Chemicals, Advance Materials, Active Ingredients, Green & Biochemicals, Paints & Coatings, Adhesives & Sealants, Water Treatment & Services, and Other end users

Which are the key drivers supporting the market growth for AI in chemicals market?

The key drivers that propel the AI in chemicals market are the increasing use of AI in research and development (R&D) processes, and the growing demand for AI-powered optimizations in chemical processes, enhancing efficiency and outcomes.

Who are the key vendors in the market for AI in chemicals market?

The key vendors in the global AI in chemicals market include IBM (US), Microsoft (US), Schneider Electric (France), AWS (US), Google (US), SAP (Germany), NVIDIA (US), C3.ai (US), GE Vernova (US), Siemens (Germany), Hexagon (Sweden), Engie Impact (US), TrendMiner (Belgium), Xylem (US), NobleAI (US), Iktos (France), Kebotix (US), Uptime AI (US), Canvass AI (Canada), Nexocode (Poland), SandboxAQ (US), Deepmatter (England), Zapata AI (US), Citirne Informatics (US), Chemical.AI (China), Augury (Israel), Intellegens (UK), Ripik.AI (India), Tractian (US), Polymerize (Singapore), ScienceDesk (Germany), OptiSol Business Solutions (India), NuWater (Africa) and VROC (Australia). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

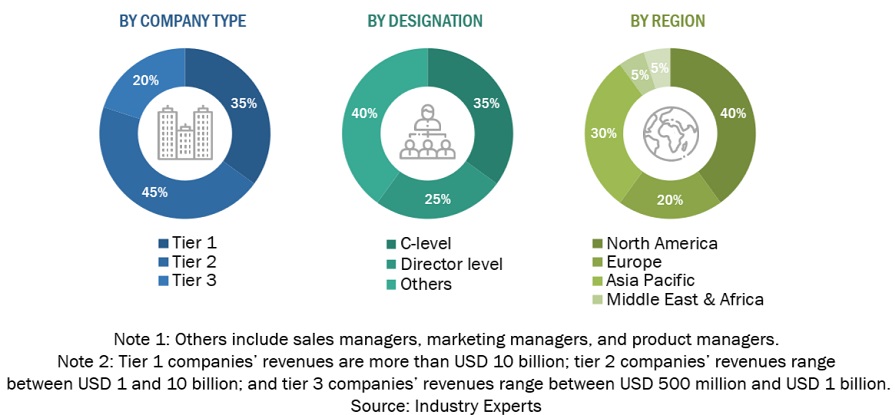

The research study for the AI in chemicals market involved extensive secondary sources, directories, International Journal of Innovation and Technology Management and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred AI in chemicals market providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering AI in chemicals hardware, software and services was arrived at hardware, software, and services was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to, for identifying and collecting identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, AI in chemicals spending of spending in various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on hardware, software, services, market classification, and segmentation according to offerings of major players, industry trends related to components, business applications, end users, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and AI in chemicals expertise; related key executives from AI in chemicals solution vendors, System Integrators (SIs), professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from hardware, software, and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understandingunderstand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using AI in chemicals hardware, software, and services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of AI in chemicals hardware, software, and services and services, which would impact the overall AI in chemicals market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

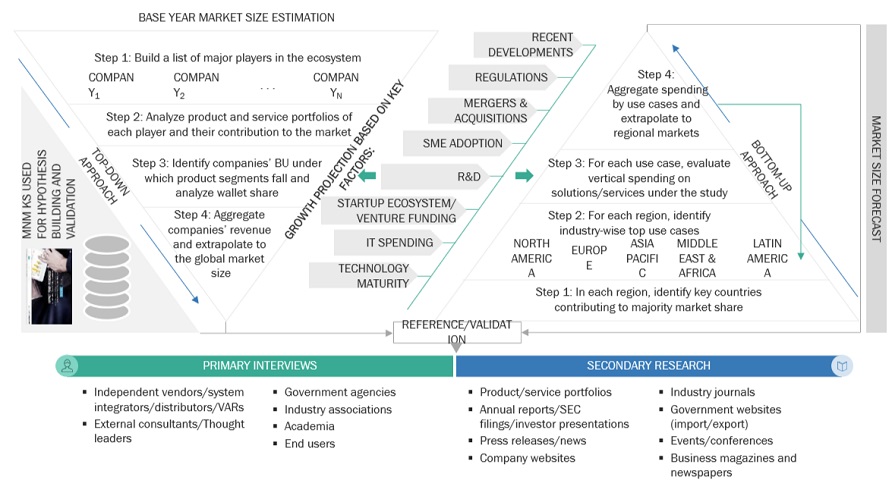

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the AI in chemicals market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of hardware, software and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering hardware, software and services in the AI in chemicals market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of hardware, solutions, solution by component, business application, end user and regions. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of AI in chemicals hardware, software and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of AI in chemicals hardware, software and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the AI in chemicals market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major AI in chemicals hardware, software and services providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall AI in chemicals hardware, software and services market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Nexocode, Artificial Intelligence (AI) is a powerful tool that can help chemical companies work smarter and faster. The technology enables more productive processes by automating tasks, providing insights into how chemicals react, or improving manufacturing environments.

AI in chemicals refers to the application of AI technologies and techniques within the chemical industry to enhance processes, improve decision-making, and drive innovation. It uses advanced algorithms, machine learning models, and data analytics to optimize various aspects of chemical production, research and development, supply chain management, and environmental sustainability. AI in chemicals enables companies to streamline operations, develop new materials and products more efficiently, and respond effectively to market dynamics, ultimately leading to improved productivity, cost savings, and competitive advantage.

Stakeholders

- AI in Chemicals Sofware Providers

- AI Technology Providers

- Professional and Managed Service Providers

- Industry Associations

- Research Institutions

- System Integrators

- Technology Consultants

- Independent Software Vendors (ISVs)

- Consulting Firms

- Value-Added Resellers (VARs)

- Government Agencies

Report Objectives

- To define, describe, and predict the AI in chemicals market by component (hardware, software, and services), business application, and end users.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall AI in chemicals market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To analyze competitive developments, such as partnerships, mergers and acquisitions, and product developments, in the AI in chemicals market

- To analyze the impact of the recession across all the regions in the AI in chemicals market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American AI in chemicals Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American AI in chemicals Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in AI in Chemicals Market