Micro Combined Heat and Power Market by Technology (IC Engine, PEMFC, Rankine Cycle Engine, Stirling Engine, SOFC), Type (Engine, Fuel Cell), Application (Residential, Commercial), Capacity (<5kW, 5–10kW, 10–50kW) and Region - Global Forecast to 2029

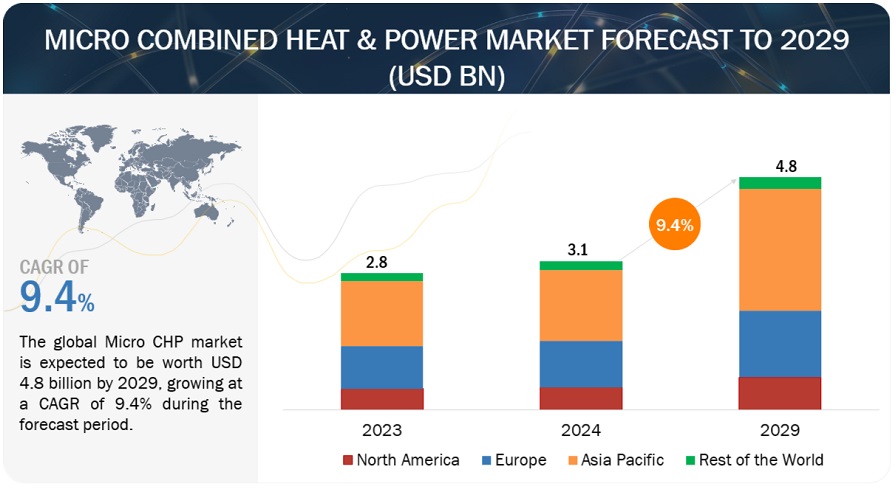

[215 Pages Report] The global Micro combined heat and power market is estimated to reach USD 4.8 billion by 2029 from an estimated USD 3.1 billion in 2024, at a CAGR of 9.4% during the forecast period. The Micro combined heat and power market is expanding due to MCHP plants capitalizing on the inherent heat produced during electricity generation from combustion of carbon fuels. By locating electric generation close to buildings, the heat generated can be harnessed for local heating purposes, enhancing overall energy efficiency and While all combustion of carbon compounds emits CO2, CHP plants boast higher energy conversion rates, leading to greater electricity or useful heat output per unit of fuel. This results in reduced carbon emissions compared to separate electricity and heating systems.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Combined heat and power Market Dynamics

Driver: Government programs and incentives to promote Micro CHP

Governments Micro Combined Heat and Power (MCHP) systems, also known as cogeneration, are efficient systems that generate both electricity and useful thermal energy from a single fuel source. Governments around the world often offer various programs and incentives to promote the adoption of MCHP systems due to their potential to reduce energy consumption, greenhouse gas emissions, and overall energy costs.

Restraint: Economic feasibility of Micro CHP systems

Moreover, micro-CHP systems generate electricity and heat simultaneously. However, the heat demand is often higher during colder months. In warmer climates with milder winters, the heat generation might not be fully utilized throughout the year. This underutilization of the heat output reduces the overall efficiency and economic benefit of the system. Also, since heat demand is lower in warmer climates, the potential for energy cost savings through micro-CHP is also reduced. This directly impacts the payback period, potentially extending it further and weakening the economic case for micro-CHP adoption in these regions.

Technological advancements that drive down manufacturing costs, coupled with broader and more substantial government support through financial incentives, are crucial to improving the economic feasibility of micro-CHP systems.

Opportunities: Replacement of boiler with Micro CHP system

Boiler replacement offers a compelling opportunity for the micro-CHP (Combined Heat and Power) market, driven by several key factors. Firstly, replacing outdated and inefficient boilers with modern micro-CHP systems allows for a significant upgrade in energy efficiency. These systems can simultaneously generate electricity and heat, utilizing waste heat that would otherwise be lost in traditional boilers, resulting in substantial energy savings and reduced utility costs. Moreover, the focus on reducing carbon emissions presents a strong incentive for boiler replacements with micro-CHP solutions, as these systems typically use cleaner fuels and employ advanced technologies to optimize energy utilization, aligning with regulatory requirements and sustainability goals.

Challenges: Greenhouse emissions regulations in various countries could be a barrier for new CHPs running on fossil fuels

Since the combustion of fossil fuels like natural gas generates CO2 emissions, new CHP plants relying on this source might not comply with these increasingly stringent regulations. This can render them unattractive investments compared to cleaner alternatives. These alternatives include CHP systems powered by renewable energy sources like biogas, biomass, or geothermal energy. Additionally, highly efficient CHP systems with carbon capture and storage technology (CCS) could also emerge as a viable option. These mandates further limit the market for new fossil fuel CHP plants. As the percentage of renewable energy in the grid increases, the need for additional power generation from natural gas CHP systems might decrease. This reduces the overall economic viability of new fossil fuel CHP projects. Some countries are implementing carbon pricing mechanisms like carbon taxes or emission trading schemes.

Combined heat and power Market Ecosystem

Leading companies in this market include well-established, financially secure producers of Micro combined heat and power products. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Major companies in this market include AISIN CORPORATION (Japan), 2G Energy (Germany), BOSCH INDUSTRIEKESSEL GMBH (Germany), KyungDong Navien (South Korea), and YANMAR HOLDINGS CO., LTD. (Japan).

The Engine-based segment is expected to be the largest market by type during the forecast period.

By type, the micro combined heat and power market is divided into Engine-based and fuel cell based. The Engine-based segment is expected to be the largest in the Micro combined heat and power market as MCHPs offer high efficiency by utilizing waste heat for additional purposes. Engine-based micro combined heat and power (MCHP) systems utilize internal combustion engines to generate electricity and heat concurrently. Engine-based MCHP systems offer flexibility in terms of fuel options, including natural gas, propane, diesel, and biofuels. This flexibility allows consumers to choose the most economical and environmentally friendly fuel source based on their location and preferences.

By Technology , the PEMFC is expected to be the Fastest segment during the forecast period.

The PEMFC segment is expected to be the fastest in the micro combined heat and power market. It's a leading type of fuel cell being actively developed for transportation applications, stationary power generation, and portable power sources. PEMFCs function based on the electrochemical reaction between hydrogen fuel and oxygen, generating electricity, water vapor, and heat as byproducts. The PEMFC cells operate at a lower temperature between 50-100°C. PEMFCs use a solid polymer electrolyte membrane, typically made of a perfluorinated sulfonic acid polymer such as Nafion. This membrane selectively conducts protons (hydrogen ions) while blocking the passage of electrons and other gases.

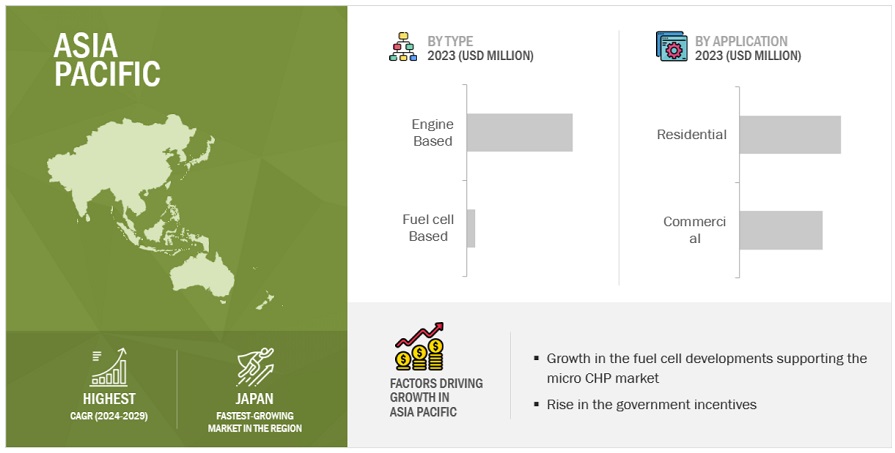

“Asia Pacific”: The largest region in the Micro combined heat and power market.

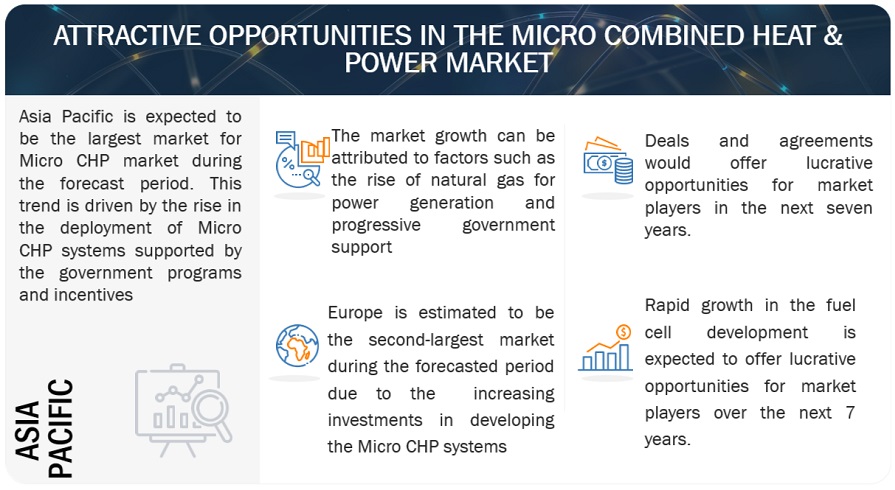

The Asia-Pacific region stands out as the largest market for micro-combined heat and power (MCHP) systems due to several compelling factors. Firstly, rapid industrialization and urbanization in countries like South korea and Japan have led to a significant surge in energy demand across various sectors, making MCHP systems an attractive option to meet this growing need efficiently. Secondly, government policies and incentives aimed at promoting energy efficiency, reducing emissions, and ensuring energy security have created a favorable environment for the adoption of MCHP technologies. Additionally, the region's diverse energy landscape, including abundant availability of biomass and waste resources, further enhances the feasibility and attractiveness of MCHP systems. Moreover, ongoing technological advancements and innovation in MCHP technologies have improved their performance, reliability, and cost-effectiveness, driving higher adoption rates in the Asia-Pacific market compared to other regions globally. These combined factors position the Asia-Pacific region as a leader in the Micro CHP market, poised for continued growth and expansion in the coming years.

Key Market Players

The Micro combined heat and power market is dominated by a few major players that have a wide regional presence. The major players in the Micro combined heat and power market are AISIN CORPORATION (Japan), 2G Energy (Germany), BOSCH INDUSTRIEKESSEL GMBH (Germany), KyungDong Navien (South Korea), and YANMAR HOLDINGS CO., LTD. (Japan). Between 2018 and 2023, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the combined heat and power market.

Recent Developments

- In September 2023, BDR Thermea Group acquired 25 percent stake to strengthen its strategic partnerships with G.I. Holding, expanding its offering of energy transition solutions for commercial and industrial customers.

- In June 2021, Toyota City and AISIN are partnering to promote household co-generation systems (ENE-FARM) with IoT technology. This Japan-first project uses IoT to measure CO2 reduction and sell credits to local companies, creating a green economic cycle.

- In August 2023, 2G Energy expands its core cogeneration business by acquiring Dutch heat pump manufacturer NRGTEQ, adding an innovative division to its portfolio. This move aligns with the growing political emphasis on electrifying the heating sector, showcasing 2G Energy's commitment to diverse and sustainable energy solutions.

- In October 2018, Bosch acquired ADS-TEC Energy for pooling its activities in the electric storage market. Bosch Thermotechnology acquires a 39% stake in ADS-TEC Energy. One of the drivers that facilitated this acquisition is the development of new products & solutions in integrating renewable energy & electromobility with the heat sector.

Frequently Asked Questions (FAQ):

What is the current size of the Micro combined heat and power market?

The current market size of the Micro combined heat and power market is USD 2.8 billion in 2023.

What are the major drivers for the Micro combined heat and power market?

The major driver of the Micro combined heat and power market is the Government programs and incentives to promote MCHP, Rise in use of natural gas for power generation.

Which is the largest region during the forecasted period in the Micro combined heat and power market?

Asia Pacific is expected to dominate the Micro combined heat and power market between 2024–2029, followed by Europe.

Which is the largest segment, by type, during the forecasted period in the Micro combined heat and power market?

The Engine-based segment is expected to be the largest market during the forecast period. The market will hold largest share due to high efficiency and growing environmental concerns.

Which is the largest segment, by the Application during the forecasted period in the Micro combined heat and power market?

The Residential segment is expected to be the largest growing market during the forecast period. Installing a micro CHP unit, which produces electricity, is expected to reduce the overall power requirement. In addition, it would drastically reduce the amount of power needed for spatial and water heating. If attached to an absorption chiller, the unit could even contribute towards cooling requirements. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

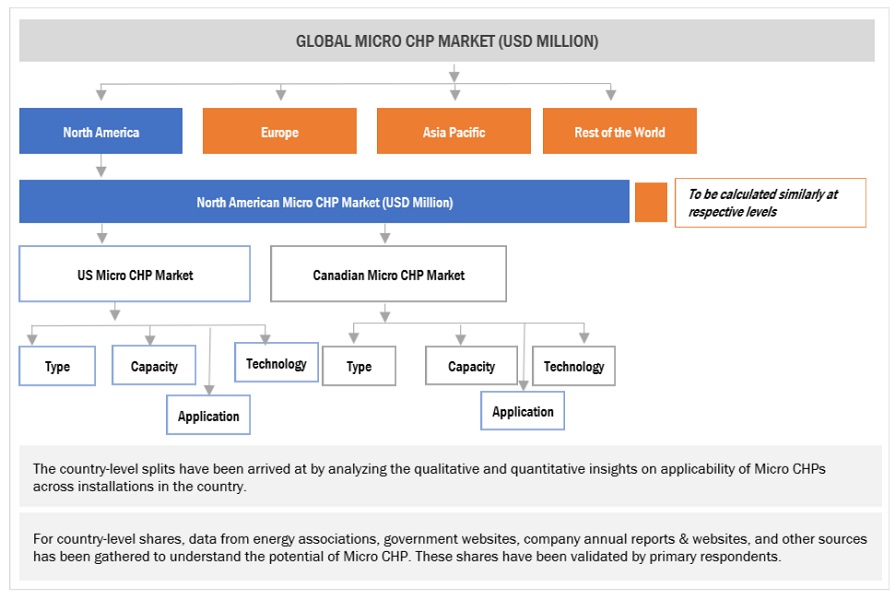

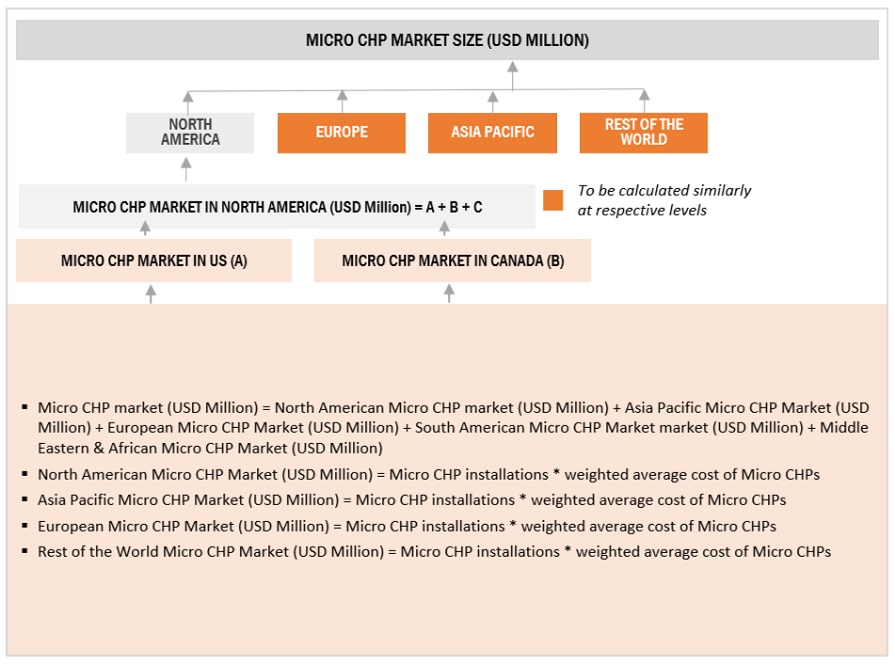

The study involved major activities in estimating the current size of the Micro Combined heat and power market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the Micro Combined heat and power market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, dealroom, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Micro Combined heat and power market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

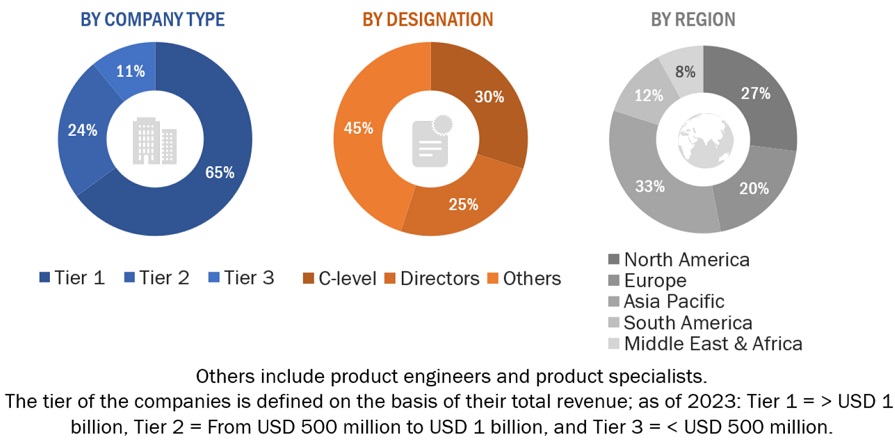

Primary Research

The Micro Combined heat and power market comprises several stakeholders such as Combined heat and power manufacturers, service providers, distributors, consulting companies from Energy & Power sector, state and national authorities and end-users in the supply chain. The demand side of this market is characterized by the rising demand for efficient energy needs. The supply side is characterized by rising demand for contracts from the industrial, commercial, utilities, and residential sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Micro combined heat and power market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Micro Combined heat and power Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Micro Combined heat and power Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Micro Combined Heat and Power (MCHP) is an energy-efficient technology that generates electricity and captures waste heat for heating or cooling purposes, all from a single fuel source. It's used to enhance energy efficiency, cut costs, reduce emissions, and bolster grid resilience. By utilizing waste heat that would otherwise be discarded, MCHP systems achieve efficiencies of up to 80-90%, compared to around 30-40% for traditional power plants. This makes MCHP ideal for commercial and residential settings, offering a sustainable and cost-effective solution for meeting energy needs while minimizing environmental impact.

Key Stakeholders

- Consulting companies in the energy sector

- Distributed energy associations

- Environmental associations

- EPC contractors for MCHP

- Manufacturers of fuel cells and engines

- Government and research organizations

- Investment banks

- Power companies

Objectives of the Study

- To define, describe, and forecast the Micro combined heat and power market based on capacity, type, technology, and application.

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To strategically analyze the Micro combined heat and power market with respect to individual growth trends, future expansions, and contributions to the market

- To provide details about the value chain of the Micro combined heat and power market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the growth of the Micro combined heat and power market with respect to 4 main regions, namely, North America, Asia Pacific, Europe, and Rest of the World.

- To strategically profile key players and comprehensively analyze their respective market share and core competencies.

- To analyze competitive developments such as investments, expansions, partnerships, acquisitions, new product launches, sales contracts, agreements, joint ventures, alliances, and collaborations in the Micro combined heat and power market

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

This research report categorizes the micro combined heat and power market by capacity, type, technology, Application, and region.

On the basis of capacity, the micro combined heat and power market has been segmented as follows:

- < 5 KW

- 5 KW – 10 KW

- 10 KW – 50 KW

On the basis of type, the micro combined heat and power market has been segmented as follows:

- Engine-based

- Fuel cell-based

On the basis of technology, the micro combined heat and power market has been segmented as follows:

- Internal combustion engine

- PEMFC

- Rankine cycle engine

- Stirling engine

- SOFC

On the basis of Application, the micro combined heat and power market has been segmented as follows:

- Residential

- Commercial

On the basis of region, the micro combined heat and power market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Micro Combined Heat and Power Market